Everything about Check Cash Payday Advance Loans

Wiki Article

Some Known Details About Payday Loans Online

Table of ContentsFacts About New Payday Loans UncoveredThe Buzz on New Direct LoansDirect Payday Loans Fundamentals ExplainedThe Payday Check Loans Diaries

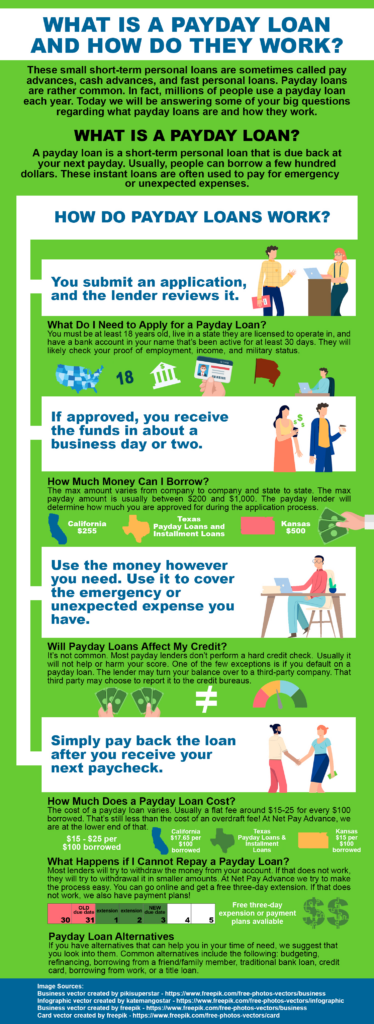

One is that many individuals that turn to cash advance do not have other funding choices. They may have bad credit history or no revenue, which can prevent them from obtaining an individual lending with much better terms. One more factor may be a lack of knowledge regarding or fear of options. For instance, some individuals may not be comfortable asking member of the family or good friends for support.

Some states, including Nevada and New Mexico, likewise limit each payday advance to 25% of the debtor's regular monthly revenue - Payday Check Loans. For the 32 states that do allow cash advance borrowing, the price of the funding, fees and also the optimum funding quantity are capped.: 37 states have certain statutes that permit payday lending.

Unknown Facts About Fast Payday Loans

If the funding term were one year, you would increase that out for a complete yearand loaning $100 would certainly cost you $391. Your lender must divulge the APR prior to you concur to the financing.Some payday loan providers will provide a rollover or renew attribute when allowed by state regulation. If the car loan is set to be due soon, the lender allows the old financing equilibrium due to roll over right into a new lending or will restore the existing lending once more.

This provides the debtor even more time to repay the financing and satisfy their agreement. It likewise means racking up huge charges if they proceed in the cycle.

That stated, they can show up on your debt record if the financing comes to be delinquent as well as the loan provider offers your account to a debt collection agency. Once a debt collector purchases the delinquent account, it has the alternative to report it as a collection account to the credit history reporting bureaus, which might harm your credit rating.

All about Direct Payday Loans

While poor credit financial debt loan consolidation financings have stricter authorization requirements, they normally bill much reduced interest rates and also fees than cash advance lending institutions. They additionally tend to supply longer settlement terms, giving you more breathing space. Since it usually supplies a reduced rate of interest rate as well as longer settlement term, a debt consolidation funding can have a reduced month-to-month payment to aid you handle your financial obligation payment.Not all states permit cash advance financing, however those that do need payday lenders to be licensed. If a cash advance is made by an unlicensed loan provider, the finance is considered gap. This means that the loan provider does not can accumulate or need the customer to pay off the cash advance loan.Each state has various legislations relating to cash advance, including whether they're readily available with a storefront payday lender or online.

A cash advance loan can address an urgent demand for money in an emergency scenario. Nonetheless, since these finances usually have a high APR, if you can not pay it back promptly, you could get caught in a ferocious cycle of financial obligation. Bottom line: It's vital to consider all your alternatives prior to approaching a payday lender.

Some personal lending institutions specialize in working with people with poor credit. And while your interest prices will certainly be higher than on various other personal fundings, they're a lot reduced than what you'll get with a payday lending.

Some Of Check Cash Payday Advance Loans

And also if you have bad credit report, make sure to inspect your debt score and record to figure out which locations need your attention. Sometimes, there could be erroneous details that could improve your credit history if removed. Whatever you do, take into consideration methods you can enhance your credit report to make sure that you'll have far better and more inexpensive loaning choices in the future. https://pastebin.com/u/ch3ckc4shlns.

In Store Loans: Approval depends upon fulfilling lawful, regulative and also underwriting demands. click site Cash loan are normally for two-to-four week terms. Some debtors, nevertheless, use cash loan for several months. Cash loan ought to not be used as a lasting economic option, and extended use may be expensive. Borrowers with debt problems should look for credit therapy.

Cash breakthroughs subject to applicable loan provider's terms as well as problems - https://businesspkr.com/listing/check-cash-loans/. ** Transunion Credit Score, Sight Control panel is a 3rd party provided service.

Report this wiki page